Does investing in Tourism affect the Saudi economy?

The Tourism Development Fund announced the signing of an agreement with the Public Authority for Small and Medium Enterprises, as part of the efforts exerted to provide support and expand the operations of small and medium enterprises in the tourism sector.

That in addition to ongoing visa reforms, and a well-planned event schedule driving the Kingdom's performance in the hospitality sector.

Hospitality markets

These factors contributed to the strong performance in the hospitality markets in Riyadh and Jeddah in the last quarter. The latest data from STR shows that the occupancy rate in Riyadh has reached 62%.

The average daily rate rose to $196 for the year ending June 2023, pushing revenue per available room up 15% year-over-year to $120.

Similar improvements occurred in the hospitality market in Jeddah, where the occupancy rate rose to 64 percent through June 2023. In the same period, the average room rate rose to $215, which in turn increased RevPAR by 21 percent to $137 compared to same period last year.

Total existing hotel inventory remained stable at 21,000 rooms in Riyadh and 16,000 rooms in Jeddah in the second quarter, approximately 1,400 rooms are scheduled for handover in the capital and 600 switches are scheduled for completion in Jeddah in the remainder year.

“While the Kingdom plans to attract 100 million visitors by 2030 in line with its ongoing diversification efforts, the strong performance in the hospitality sector reflects the success of its many strategic initiatives that help boost tourism,” said Saud Al Suleimani, Regional Director of JLL.

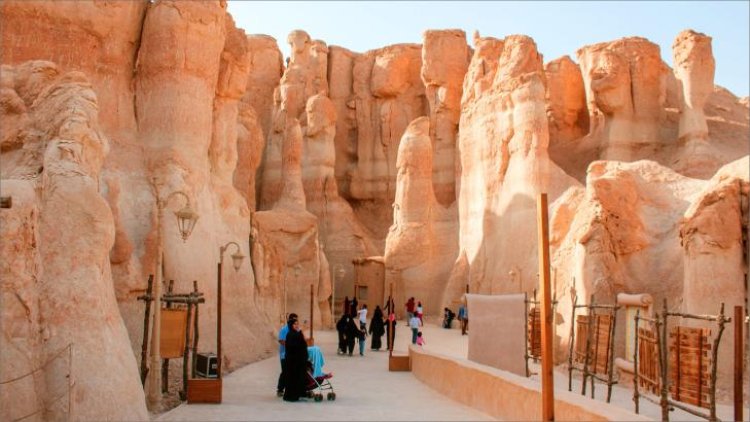

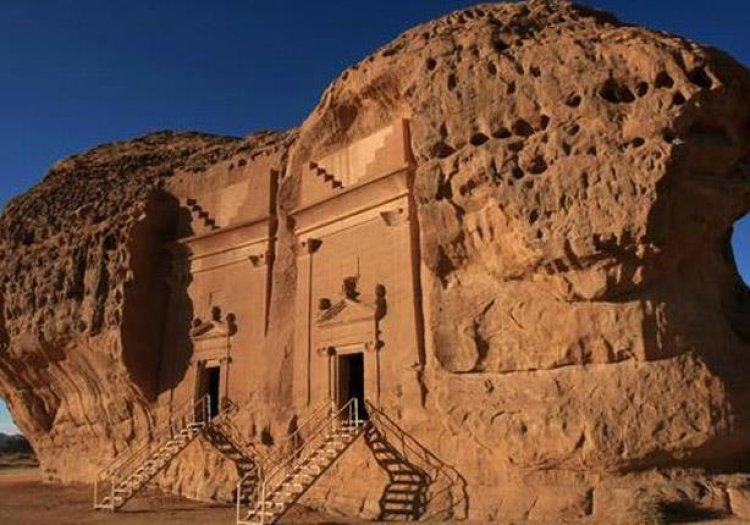

This comes through simplifying visa procedures, increasing air connectivity, developing many tourist attractions - and ultimately market access - and hosting many local and international events.

The largest investors in tourism

The Saudi government has made great efforts to attract investment into the country. Today, the Kingdom is recognized as one of the largest investors in tourism in the world, with existing and new investments aimed at propelling its growth and positioning as a year-round tourist destination.”

The second quarter saw retail space in Jeddah grow by about 102,300 square meters to reach 1.9 million square meters, while the completion of two mini-centers and the expansion of a regional mall added nearly 49,500 square meters of total leasable retail space in the capital. Total inventory increased to 3.4 million square meters.

Average rents have increased

In Riyadh, average annual rents for major regional and regional malls increased by 9% and 8%, respectively. However, Jeddah's retail market slumped, and average rents for major regional malls fell 17% year-on-year in the second quarter. In contrast, average rents in regional shopping centers in Jeddah increased marginally by 1 percent compared to the same period last year.

With rapid growth and transformation, retail projects in the Kingdom are no longer seen as a place to shop alone.

Shopping centers

Malls have evolved into a place for socializing with an increased focus on enhancing the customer experience. In addition, in line with the growing popularity of online e-commerce, there has been a growing shift towards multi-channel retailing. As retailers aim to meet the evolving needs of customers, they offer the ability to shop online, in-store, or through a combination of both channels.

The residential sector

Meanwhile, the Kingdom's residential sector continued to respond to market dynamics. Despite the addition of about 8,000 new units, which raised the housing stock in Riyadh to 1.4 million units, and about 4,000 units were delivered in Jeddah in the second quarter of 2023, a slowdown in residential transactions was observed due to the rise in prices.

The total number of deals decreased by 2 percent in the capital and 17 percent in Jeddah, according to the latest data from the Real Estate Authority. Apartments and small units are in high demand across the Kingdom due to their relative affordability.

Shrouq

Shrouq