Will the Chinese yuan eliminate the hegemony of the dollar?

Increasing interest rates on the dollar leads to an increase in the strength of the US currency against other currencies, while the rest of the economies try to maintain the attractiveness of their currencies with similar increases in interest rates.

The rise in interest rates on the US dollar since 2022 has increased the cost of obtaining the US currency on the part of emerging markets, in addition to exhausting its foreign trade payments.

So that, Argentine Minister of Economy, Sergio Massa, announced that his country intends to pay the price of its Chinese imports in yuan (the Chinese currency) instead of the US dollar, in order to limit the depletion of its hard currency reserves.

Argentina was severely affected by the US Federal Reserve's interest rate increases on the dollar, which increased the cost of obtaining the US currency on the one hand, and raised the cost of debt denominated in dollars, on the other hand.

Increasing interest rates on the dollar leads to an increase in the strength of the US currency against other currencies, while the rest of the economies try to maintain the attractiveness of their currencies with similar increases in interest rates.

chip war

on the other hand, the "chip war" between China and the West has led the United States to impose sanctions on the Chinese electronics and technology industry, and to impose restrictions on the export of chip-making equipment to China.

The United States also imposed sanctions on "Huawei Technologies", a Chinese telecommunications equipment maker.

The British government ordered the Chinese company "Wing Tech Technology" to sell most of its stake in a semiconductor factory in the Principality of Wales, claiming British national security considerations.

Reduce dependence on the dollar

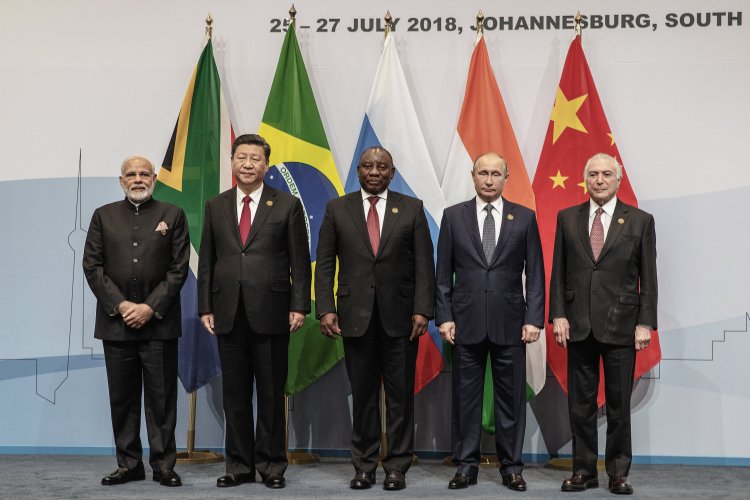

The Chinese approach to reduce dependence on the dollar supports a great agreement with Moscow. Last week, Russian Deputy Prime Minister Alexander Novak said that Russia will continue to accept payments for energy exports in Russian rubles and Chinese yuan, in light of Moscow's efforts to abandon dealings in US dollars and euros.

A Reuters report in the middle of this month confirmed that large sovereign funds in the Middle East are working to strengthen their portfolios of Chinese stocks.

The Shanghai Petroleum and Natural Gas Stock Exchange announced at the end of last month that the China National Offshore Oil Company (CNOC) and Total Energies have completed China's first liquefied natural gas (LNG) transactions to be settled in yuan. It said in a statement that the transaction included about 65,000 tons of liquefied natural gas imported from the UAE.

Abandon the dollar

In March, the Brazilian government announced that it had reached an agreement with China to abandon the dollar and use their local currencies in bilateral trade.

The agreement will allow China, the biggest rival to US economic dominance, and Brazil, the largest economy in Latin America, to conduct their massive trade deals directly and replace the yuan with the real and vice versa, instead of relying on the dollar.

China and five Central Asian countries are also seeking to enhance cooperation in areas including agriculture and e-commerce.

Shrouq

Shrouq