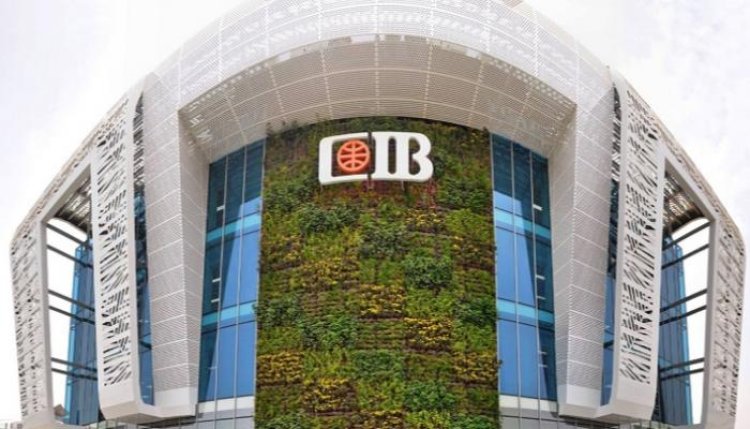

Days after posted..Commercial International Bank suspends 22% certificates

The Commercial International Bank (Egypt), announced the issuance of 3 new certificates for 3 years, with interest rates ranging between 18 and 20%.

The Commercial International Bank of Egypt decided to stopped the 22% certificates, days after issuance, while it decided to issue 3 new certificates for 3 years, at interest rates ranging between 18 and 20%.

22% certificates stopped

The Commercial International Bank announced issuance of investment certificates for a period of 3 years, with a fixed return of 22%, to be paid monthly.

The bank stated that the minimum purchase amount for the new certificate is 3 million pounds, and multiples of 1,000 pounds.

“Plus” certificates “19% return”

The bank also offered “Plus” certificates for a period of 3 years, with a fixed return of 19%, with a minimum purchase amount of EGP 200,000.

“Prime” certificates ” 18% return”

“Prime” certificates for a period of 3 years, with a fixed return of 18%, and the minimum purchase is 10,000 pounds and multiples of 1,000 pounds.

“Premium” certificates “20% return”

The bank announced the issuance of “Premium” certificates for a period of 3 years, with a fixed return of 20%, and the minimum purchase amount is one million pounds and multiples of one thousand pounds.

National Bank of Egypt and Banque Misr

Earlier, the National Bank of Egypt and Banque Misr offered two new savings certificates for a period of 3 years, with a fixed return of 19% and a declining 22%.

Offering the first certificate for a period of 3 years, with a fixed return of 19% annually, to be paid monthly.

The second certificate for a period of 3 years, with a decreasing interest rate of 22% for the first year, 18% for the second year, and 16% for the third year, and the return is paid monthly.

The Central Bank of Egypt announced that it would raise the basic interest rates by 200 basis points.

Shrouq

Shrouq