The Administrative Capital and fourth generation cities are the password to attract foreign investments to Egypt to improve the credit rating

There is no doubt that 9 years of work in various parts of Egypt in the field of urbanization and infrastructure had a strong impact in attracting foreign investments to Egypt, improving Egypt’s credit rating, and placing Egypt on the map of major countries, due to the fourth generation cities, which the Egyptian government aims to be. Serve as centers for entrepreneurship.

9 years of development and urbanization that Egypt has not witnessed over the past decades. Today, Egypt is reaping the fruits of the national projects announced by President Abdel Fattah El-Sisi since assuming responsibility for ruling the country in 2014, from unprecedented urban development, road projects, the Suez Canal development axis, and fourth generation cities. And other major projects that placed Egypt among the ranks of developed countries and made it the first destination for investment in the entire Middle East region.

New cities

Dr. Walid Abbas, Vice President of the Urban Communities Authority, said that the Ministry of Housing plays a major role in drawing the real estate map of Egypt and supporting the economy through establishing and establishing new cities. He reviewed the Ministry’s package of measures to attract investment through the multiplicity of opportunities and the diversity of allocation mechanisms.

As well as indicators of investment support and its impact on the real estate market, and the measures taken by the Egyptian government to confront potential risks in the Egyptian real estate market. He explained that investors’ requests for land in dollars amounted to 629 requests, with a total area of 1,089 acres, during the months of August and September 2023.

The first nine months of 2023 witnessed a high demand for investment opportunities at a rate of 42% compared to the same period last year. He pointed out that the government is planning to offer a number of investment opportunities in new cities, as 201 opportunities will be offered during the last quarter of 2023, and 1,029 opportunities during the year. 2024.

Real estate investment map

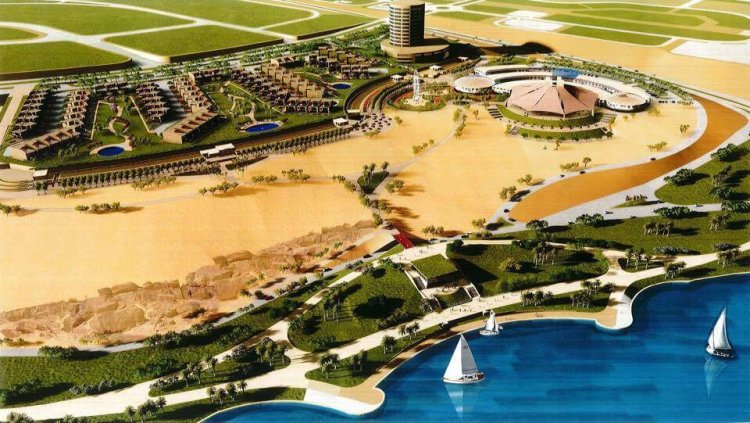

Abbas reviewed the map of real estate investment according to urban development projects and fourth-generation cities, as the number of fourth-generation cities in Egypt currently stands at 39 cities, led by the new city of El Alamein, which is considered a global financial and tourist center and a center for scientific research, and is being implemented with investments exceeding 199 billion pounds.

He stressed that the volume of investments in new cities has reached 705 billion pounds so far, including 163 billion pounds of investments in the New Administrative Capital, thanks to a group of factors that distinguish investment in Egypt, where there is a strong infrastructure and a smart transportation network to connect all parts of the republic. The availability of land and facilities ready for implementation, in addition to lower prices compared to surrounding countries, the availability of labor, the increasing volume of annual housing demand, and the multiplicity and diversity of investment aspects in many tourism, real estate, gas and oil sectors.

Incentives and facilities

He pointed out that there are a number of incentives and facilities provided by the government to investors in support of the Egyptian real estate market, the most important of which is granting additional periods for implementation at a rate of 20% of the original and additional deadlines, and allowing developers and investors to participate in the project of obtaining citizenship in exchange for purchasing real estate in US dollars, and considering reaching a completion rate. 80% for all investment projects in implementation of the project, provided that the facilities are fully implemented.

He explained that the government also allows increasing the exploitation factor for plots of land with integrated urban activity by 10% of the original exploitation factor, allowing the percentage of service lands to be increased from 12% to 15% of the project land area for integrated urban activities, and allowing the industrial developer to plan and divide industrial lands up to 75%. Of the project land area.

Shrouq

Shrouq