Egypt and Saudi Arabia are discussing the use of the pound and riyal in trade

Egypt and Saudi Arabia are examining the possibility of using local currencies in part of their trade exchange during the coming period, according to the head of the Commercial Representation Authority of the Egyptian Ministry of Trade and Industry, Yahya Al-Wathiq Billah.

Al-Wathiq Billah's statements come on the sidelines of a visit to Cairo by a Saudi delegation headed by the Minister of Commerce, Majid Abdullah Al-Qasabi, and including many Saudi businessmen. The visit began Sunday and continues until Monday.

Al-Wathiq Billah added, “The Saudi Minister of Commerce submitted a proposal to discuss the possibility of paying part of the trade exchange operations in local currencies, and the proposal will be subject to discussions between the central banks of the two countries,” expecting that studies of this proposal will be completed during 2024.

The volume of trade exchanges between the two countries

Figures from the General Authority for Statistics in Saudi Arabia indicate that trade exchanges between the two countries amounted to $20.4 billion during the past year.

Trade exchange operations

This is not the first attempt in which Egypt is looking for alternatives to intra-trade away from the dollar, as Cairo and Turkey reached, in August, a mechanism for implementing trade exchange between the two countries in the Egyptian pound and the Turkish lira, coinciding with Egypt’s call to join the “BRICS” group, which is This will help it carry out trade exchange operations in local currency with the member states, Saudi Arabia, the Emirates, Argentina, Iran, Ethiopia, Russia, Brazil, India, China and South Africa.

Egyptian economy

The head of the Commercial Representation Authority also indicated that the talks with the Saudi side touched on “several axes, including industrial integration for export to Africa, and developing an integrated map for the industry between the two countries.”

Saudi Arabia has deposits in the Central Bank of Egypt worth $10.3 billion, of which $5 billion are short-term deposits, and $5.3 billion are medium- and long-term deposits, according to the latest report issued by the Central Bank regarding the external situation of the Egyptian economy.

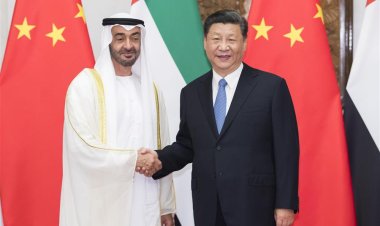

Egypt and the Emirates

On September 30, 2023, Egypt and the UAE concluded an agreement to swap local currencies, signed by the governors of the two countries’ central banks. The currency swap agreement allows the exchange of goods and merchandise between its parties in the local currency of each, at the value of what was agreed upon within its framework, which in the case of Egypt and the UAE, is approximately five billion UAE dirhams and 42 billion Egyptian pounds.

Currency exchange between Egypt and Russia

This amount will be according to the prevailing exchange rate at a specific time, which means that Egypt has guaranteed, under the recent agreement, to obtain five billion UAE dirhams, even if the value of the Egyptian pound declines against the dollar again.

One of the goals that are usually hoped for by signing such agreements is to reduce the demand for the US dollar, by financing the two countries’ trade relations with the local currency, as well as fixing any imbalance in the exchange rate system and securing foreign debts at lower costs.

On September 25, 2023, in a painful blow that threatens the dominance of the US dollar around the world, Russia allowed 31 countries, including Egypt, to trade in its financial markets in the local currency, which means dispensing with the “green” and dealing between Cairo and Moscow in the Egyptian pound and the Russian ruble, which means significantly reducing the pressure on demand On the US dollar.

Shrouq

Shrouq