$31.5 billion investing.. “Saudi” is the most active sovereign fund in the world

The assets of Gulf wealth funds reached a historic peak of $4.1 trillion in 2023

The Saudi Public Investment Fund topped the list of sovereign funds in the world during 2023 in terms of activity, as it pumped investments worth $31.5 billion, an increase of 33% compared to 2022.

The fund concluded 48 deals, 42% of which were in the Kingdom, according to a report issued by the Sovereign Fund Institute. Within a short period of eight years since its restructuring, the Saudi sovereign fund has become a major force at home and abroad, and aims to become the largest sovereign fund in the world by 2030, according to the Kingdom’s vision.

Assets of sovereign funds in the Gulf

During 2023, the value of sovereign fund assets in the Gulf region reached a historic peak of $4.1 trillion, compared to $3.8 trillion in 2022.

The decline of Gulf sovereign funds

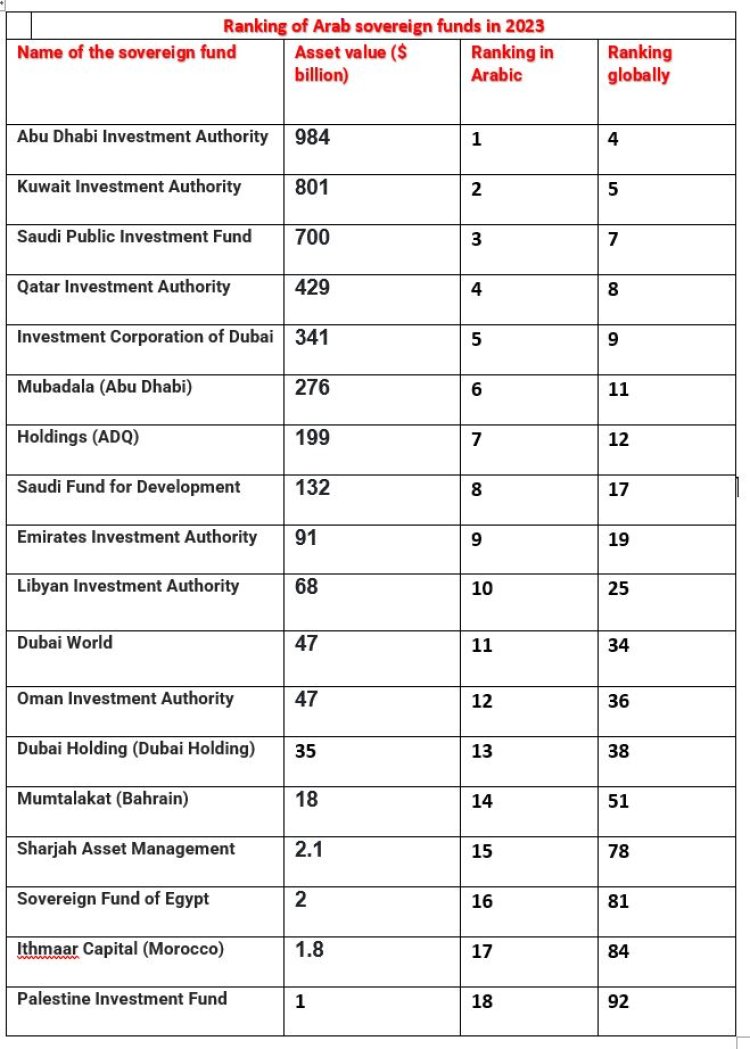

Other sovereign funds in the region also outperformed their global counterparts in terms of activity, namely: Abu Dhabi Investment Authority, Mubadala and Holding Company (ADQ), in the United Arab Emirates, and the Qatar Investment Authority.

But overall, investments pumped by Gulf sovereign funds declined to $75.6 billion, compared to $85.9 billion in 2022.

One of the reasons for the activity is the continuing high level of oil prices, as Gulf funds reaped the benefits of unexpected financial gains and recovered faster than others from the financial market disaster in 2022, according to the report.

This activity is also due to the maturity of the investment scene, with a wide range of players entering the local and global markets with an unprecedented level of development. This has enhanced economic diversification, which is expected to push growth in the GCC to 3.6% and 3.7% in 2024 and 2025, respectively, according to the World Bank.

Growth at a steady pace until 2030

Globally, the value of assets managed by sovereign funds rose to $11.2 trillion in 2023, compared to $10.5 trillion in 2022.

The report expects sovereign funds to continue to grow at a steady pace until 2030, bringing the value of the assets they manage to $71 trillion, led by the Norwegian sovereign fund, the Saudi Public Investment Fund, and the Japanese Government Pension Investment Fund (GPIF), known as the largest pension fund in the world. With a value of more than two trillion dollars each.

Compared to 2022, sovereign fund investments globally decreased by 21% to $123.8 billion through 317 deals.

The outlook for 2024 remains uncertain, “with high geopolitical risks, but we believe SWFs will continue to weather crises,” the report said. The Fund of the Year award went to the Norwegian fund, thanks to recovering returns, leadership in stewardship and possibly its foray into unlisted private companies.

The report revealed that the value of green investment peaked at $25 billion in 2023.

Shrouq

Shrouq