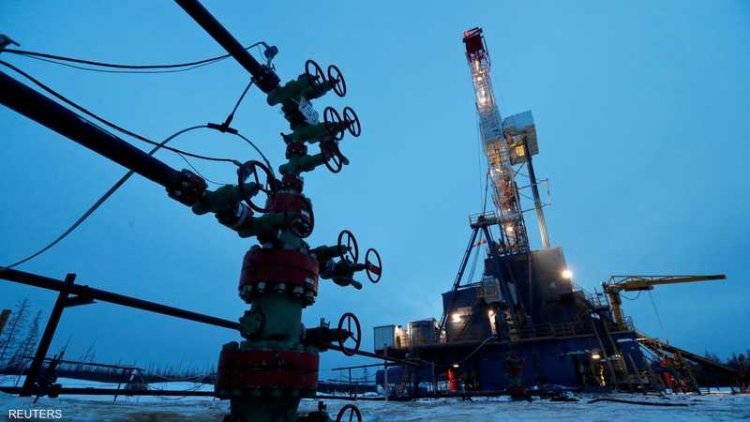

Although it is the world's largest importer... Why did China's oil purchases decline?

China received 125 crude oil tankers until late April 2023, so will Beijing's oil demand decrease?

China's recovery may disappoint some oil bulls, even though it is the world's largest importer of crude oil by sea.

Ship tracking data collected by the US agency “Bloomberg” showed that 125 supertankers capable of transporting 250 million barrels were on their way to the Asian country at the end of last month, and this is the highest in more than two years.

An increase in buying

According to the US network, cargo loading data for the month of April confirm that China is preparing to receive more oil. The data shows numbers for what were known to be overbought. In February, traders reported an increase in purchases from Unipec, the trading arm of refining giant Sinopec, by snapping up millions of barrels from the Middle East, the US and West Africa.

Bloomberg explain , traders participating in the Asian physical market said that China's appetite for oil will likely remain relatively healthy, although it is unclear whether it will be as strong as it was earlier this year. Oil futures contracts have been affected recently amid concerns about the deteriorating economy, and are down about 17% since mid-April.

According to Bloomberg, Asian refiners typically book spot crude oil shipments two months in advance of when they are needed.

Big gains

An increase in China buying earlier this year after the exit from the zero Covid policy led to a jump in the traffic of supertankers heading to China.

As for the actual shipments for the month of April, shipments from Brazil, the United States and other Arab countries and the Russian Pacific region witnessed significant gains.

Increase profit margins

The US agency noted that Chinese refiners, unlike most buyers elsewhere in Asia, were able to buy discounted oil from producers in Russia, Iran and Venezuela, supporting their profit margins.

Theoretical refining margins for smaller independent refiners as of late April were 1,012 yuan per ton, or about $19 a barrel, up more than 20 percent.

Shrouq

Shrouq