The market awaits Qatar's faltering deals in Egypt

Qatar has also shown interest in investing in several Egyptian companies

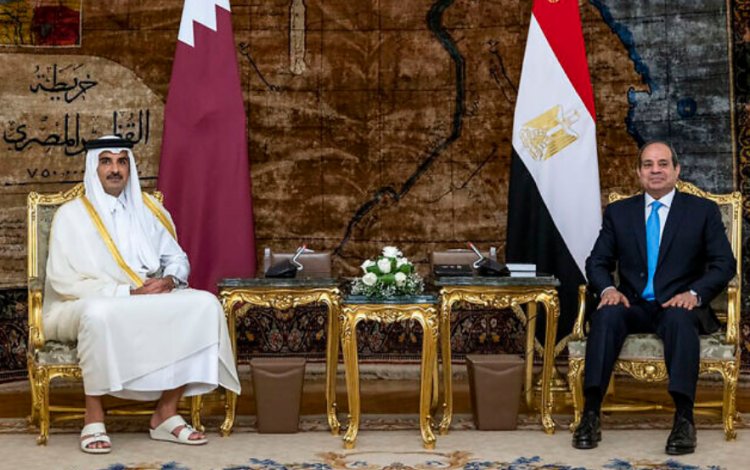

The Egyptian market is awaiting the partnership and acquisition agreements between Egypt and Qatar, which are expected to result from the visit of Prime Minister Mustafa Madbouly, who is heading an economic delegation to the Qatari capital, Doha.

The government is seeking to attract foreign direct investment and sign agreements to sell stakes in assets owned by it as part of its plan to finance the dollar gap.

Several sectors

The prospective deals are concentrated in several sectors, on top of which is communications, as news of negotiations between Egypt's sovereign fund and the Qatar Investment Authority to obtain part of Telecom Egypt's stake in Vodafone Egypt, amounting to about 45%, have been circulating for months.

Qatar has also shown interest in investing in several Egyptian companies, such as the state-run Kima Aswan Company, while observers expect that Egypt will offer the Qatari sovereign a stake in The United Bank, which did not receive a final offer to acquire from any of the Saudi and UAE sovereign funds after negotiations last year.

$ 320 million last month

Container companies, which the government proposed for partnership within the bidding program, may also be targeted, as the Prime Minister announced that Port Said Container Handling Company and Damietta Container Handling Company are among the 32 companies included in the program.

The Qatari Al-Kuwari Group submitted an offer to the Arab International Company for Hotels and Tourism to buy the Ramses Hilton Hotel in Cairo for about $ 320 million last month, according to what was reported by "Al Sharq Bloomberg" website.

The Qatar Investment Authority, the country's sovereign wealth fund, is in talks with Egypt about possibly investing in seven historic hotels there, in a deal that could mark a milestone between the two countries that restored diplomatic relations in 2021 after a long-running dispute.

Two informed sources, speaking on condition of anonymity, said the Qatar Investment Authority was in talks with Egypt's sovereign wealth fund about the deal.

The two sources added that the fund is considering acquiring a stake of up to 30% in hotels, without naming it.

Qatar Investment Authority

The Qatar Investment Authority, which has $445 billion in assets, declined to comment. Egypt's sovereign fund did not immediately respond to a request for comment.

Egyptian economy

The Qatari Minister of Finance said last month that his country is committed to pumping investments worth five billion dollars into the Egyptian economy, in implementation of a promise it made last year.

Economic relations between Egypt and Qatar have witnessed remarkable development in recent years. Qatar is the third largest Arab investor in Egypt during 2021/2022, through many major companies operating in Egypt, and the remittances of Egyptians working in Qatar are of great importance to foreign exchange flows to Egypt.

Qatar is the third largest Arab investor in Egypt during 2021/2022, and Qatar's investments in Egypt during 2021/2022 amounted to about $518.7 million, compared to $507.9 million during 2020/2021.

The most important Qatari companies operating in Egypt are Qatar National Bank in the financial services sector, Al Diar Real Estate Company in the real estate sector, and Qatar Energy Company in the energy sector.

Shrouq

Shrouq