" including food industries, real estate development, and pharmaceuticals".. 6 priority sectors for investment and export

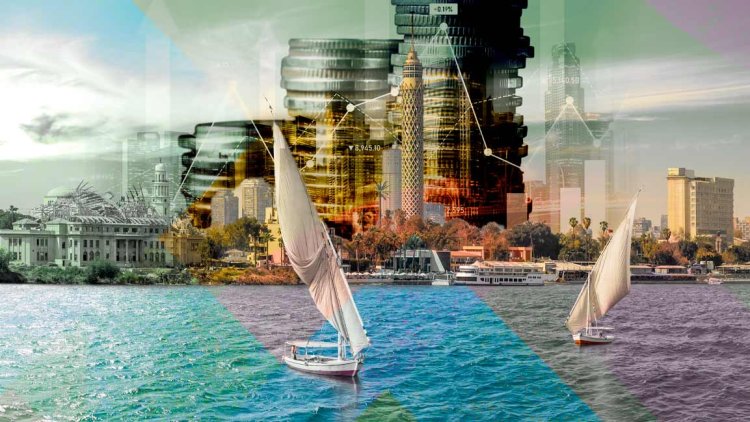

Engineer Hossam Heiba, CEO of the Investment and Free Zones Authority, revealed that financial indicators for the volume of foreign direct investments in Egypt by the end of the fiscal year 2023 indicate achieving a growth of 10% over last year.

According to data issued by the Central Agency for Public Mobilization and Statistics last June, the fiscal year 2021/2022 witnessed the largest increase in foreign direct investment flows to Egypt, after they increased by 71.4% to record $8.9 billion.

Attracting investments

Heiba explained that Egypt is first in Africa and second in the Middle East in attracting investments, after the UAE in first place.

Heiba added, through the bank’s banking association, the specialized market in attracting investors in light of the Saudi Arabian competition. Egypt is one of the centers with the most access to African markets, thanks to cooperatives, relationships, and acceptance from the peoples and governments of African countries.

Attracting foreign investment

He stressed that Egypt has great attractive power, and is considered a regional center for attracting foreign investment and capital looking for stability, and targeting exporting countries, especially in light of what many countries of the world suffer from the high cost of production and problems in energy, supply chains, and access to markets.

Allocating industrial zones

Heiba pointed out that the Authority had noticed great interest from foreign countries in obtaining lands and allocating industrial zones, pointing out that in the past 6 months the Authority had allocated 4.5 million square meters.

Heiba add that, at the beginning of this year, the Authority developed a strategy to promote investment opportunities and create a business climate in two main axes: the first is to identify problems and develop radical solutions to them, and the second is to reconcile with investors by resolving disputes away from the courts.

Communication platform

He pointed out the launch of a communication platform with business organizations that includes all officials and meets periodically to develop executive mechanisms to solve problems. He welcomed cooperation with the Egyptian Lebanese Businessmen Association in promoting Lebanese investment opportunities in Egypt.

Investor problems

Heiba explained that the authority has taken control of the problems of 6 priority sectors for the current stage. Including food industries, real estate development, medicines, and cement, noting that they are classified into general problems, such as the import process, and others specialized according to each sector, while summoning the authorities responsible for solving these problems.

He explained that the most important decisions that were taken to solve investors’ problems were the Ministry of Finance’s creation of a clearing system between investors’ dues and their tax or other burdens for the benefit of government agencies, while setting a time limit of 45 days to ensure speedy return of value-added tax and speed up procedures.

In addition to making amendments to granting citizenship, and working to encourage the private sector to open new markets with the aim of increasing exports, especially to Africa.

Update the investment map

He pointed out that the investment map has been updated to allow the private sector to develop its investment opportunities and partnerships, including 60 opportunities, and to work within an international map of the most important target countries to promote investment opportunities in Egypt.

He stressed that the establishment of service companies was allowed under the Private Free Zones Law, and the service activities in which Egypt has a competitive advantage were identified, such as mining, ICT, and others.

Financial center for service activities

“Heiba” revealed that the Authority is looking into establishing a financial center for service activities similar to Cyprus, within the framework of the second phase of the Authority’s strategy to create a business climate and attract investors. These are financial service areas that have special legislation that allows foreign companies to deal inside Egypt and not deal outside the country and without customs.

It is renewed for 10 years, in activities such as insurance, investment funds, financial consulting, holding and family companies, as well as tourism companies.

22 golden licenses

“Heiba” pointed out that 22 golden licenses worth 264 billion pounds were issued, which is a single approval for licenses for activity, buildings, environmental approval, and civil defense, in addition to lands.

Shrouq

Shrouq